Goldcorp: The Oxymoron of Fiat Creation

Goldcorp has taught me a lot about what can be hidden in a stock. When I look at the dynamics of what drives a gold stock, the gross irony of Goldcorp is that, from my point of view, it is the epiphany of investor fears that is driving the gold bull in the first place.

So, just what are investor fears driving the gold market? The answer I get is currency devaluation due to government just printing more money. As the money supply grows, there is an escalation of inflation. The U.S. national debt is so enormous, printing money to pay bills seems more likely, so this is a serious and valid concern. Governments printing money is the cause of hyper-inflation.

Gold is supposed to be protective against this. Gold should hold its value against other currencies. This makes a certain amount of sense, however, gold stocks are not gold. They represent business that mines gold. They do not mine the gold and just sell enough to cover expenses and then save the hard asset that is supposed to protect valuation; no, they tend to sell all that they mine, paralleling the gold bug complaint that the gold that used to back currency has been sold off.

Gold companies do not print money, however, they do print stocks. Stocks are to a business what currency is to a country. If a business is printing stock, or issuing new equity, it is very comparable to government printing more money.

Just How Many Shares Has Goldcorp Printed?

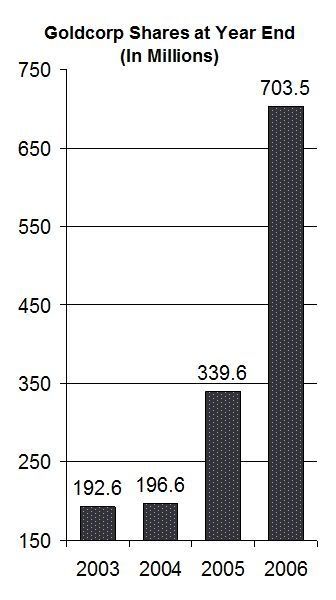

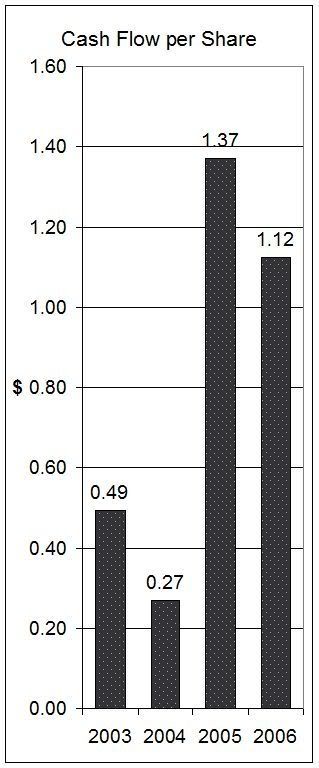

The graph below show just how frivolous Goldcorp is with issuing new equity, options and warrants. Options and warrants are included and must be included to get a true picture of a company.

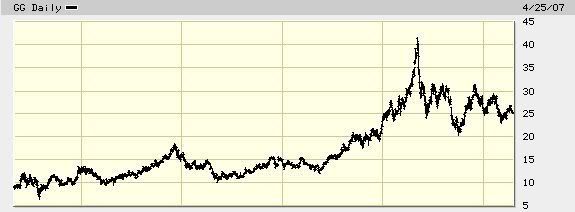

Dilution is easily hidden. It can be found, but it really doesn't show up in a chart of the company's performance, like this one on Goldcorp's share price:

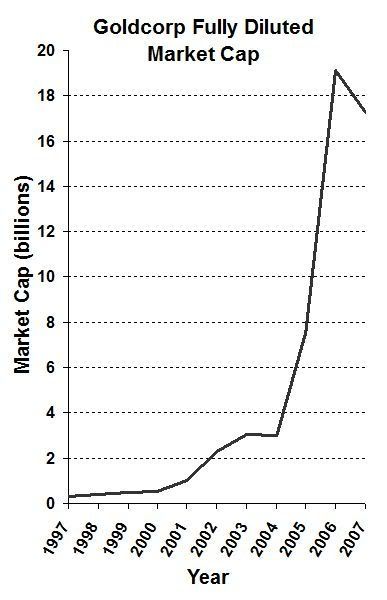

A chart of a company's share price completely and utterly hides dilution. To see a true picture of performance, you really need to look at a graph of fully diluted market cap. But where do you get that? As far as I can tell, it just doesn't exist, but it is probably one of the strongest pictures of how the market is valuing a stock.

There is no way that I can go back and figure out fully diluted share/warrant/option count on a daily basis and multiply it by the share price, but, I could do it for 10 points, say at the end of each year.

There were events tied to issuing of new equity. Some was to pay back debt, much like how governments have printed currency to pay back loans. Other events were asset acquisition, such as the take over of Glamis.

The midas touch, $6 billion of fiat book value in a single deal

Glamis was a gold producing company with a good development property. Their book value in their Q3 financial report before the takeover was $2.2 billion dollars. When Goldcorp took over Glamis the cash and equity value of what they issued was $8.2 billion dollars, and Goldcorp now carries $8.2 billion dollars in assets on their books for the Glamis properties.

Essentially, Goldcorp has a hyper-inflation of asset valuation being carried on their books. As assets are mined from the ground, an appropriate allocation of book value for each mine is written off.

The hyper-inflated Glamis assets are currently mostly non-producing assets, so what is currently written down is tiny compared to the total asset picture of Goldcorp, and it is tiny compared to the relative book value that the company is carrying for all of its properties. Once these assets start producing the writing down of the fair allocation of book value of these hyper-inflated assets will implode earnings.

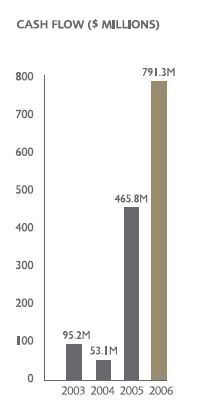

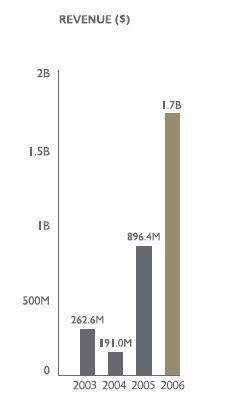

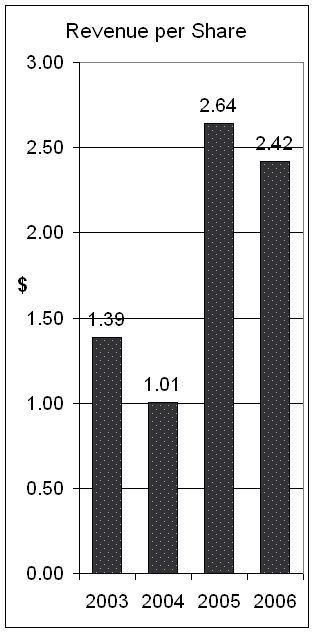

I find that Goldcorp is masterful at taking the focus from what ought to be the first priority for investors and and spinning impotent results into a good story. For example, look at the graph of revenue. It tells a stellar growth story, but merely looking back at the total share count suggests the revenue growth is inadequate compared to the equity growth.

Indeed, the revenue per share has actually declined.

But again, the per share picture isn't so pretty, it is actually down 22%.

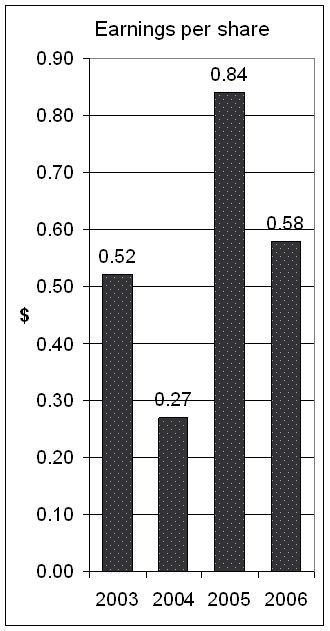

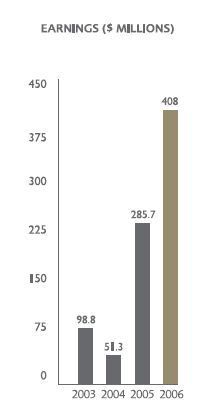

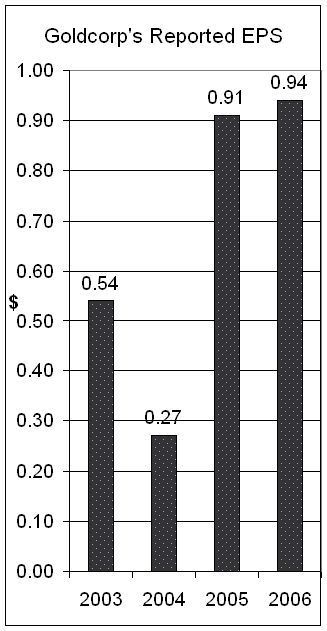

But not to be disuaded, I decided to look at the next "Go Goldcorp!" graph, which was earnings, and again, their presentation looks stellar.

When you use Goldcorp's numbers for individual shareholders, it actually does look like an improvement.

But I check calculations for myself I found $408 million in earnings when there were 703.5 million shares fully diluted did not "add" up to what they report. Practically none of the effects of share dilution and fiat book value from the Glamis merger show up in the financial reports. I took the earnings and the fully diluted share count at year end and re-plotted the data. This is ultimately what share holders are getting.

In 2003 with 52c eps Goldcorp was trading under $16.

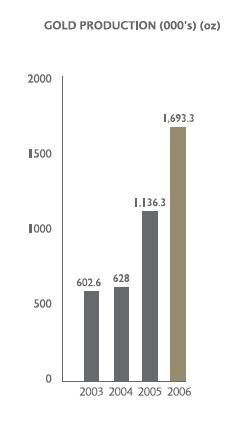

Goldcorp also puts its spin on gold production based on ounces for the company as a whole.

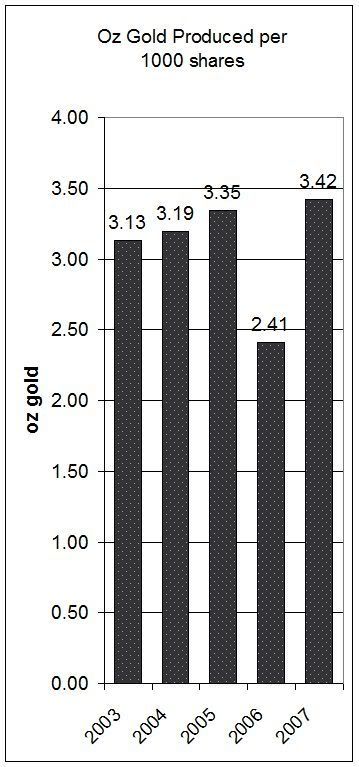

But, what Goldcorp is producing per share is far more important. The graph below is actually per 1000 shares, and the 2007 point is projected production. Already for 2007 production has been down graded twice from 2.8 million ounces.

The 2006 figure has totally imploded. With about $24,000 US investment you can expect to see about 2.4 ounces of gold produced. It begs the question, how can anyone possibly think that this is reasonable? If they meet their targets for 2007, the gold production per share will return to the historical levels.

All in all, Goldcorp belongs to the honor role for the frivolous cap of fiat creation.

10 comments :

Excellent article, Deborah!

Back in '05 Goldcorp took over Wheaton River Minerals in what was a heated battle as Glamis was trying to take over Goldcorp. The CEO of Goldcorp at the time (Rovert McEwen) was wildly opposed to getting taken over by Glamis, even threatening to dump all his shares on the market to drive down the price and punish his fellow shareholders. Many thought Glamis stock overvalued and, indeed, Wheaton sported a much lower PE.

Goldcorp ended up rejecting the Glamis deal and took over Wheaton River. As part of the takeover the CEO of Wheaton (Ian Telfer)became the CEO of the combined company. This was a selling point of the deal that McEwen trumpeted - he insisted that Telfer was the man to succeed him. Another major point was that the combined company would still be considered a gold mining company and so sport a high PE, but because Wheaton was a low PE, mainly copper producer, the stock price would likely go up after the takeover.

Goldcorp ended up getting its rich stock valuation, so rich in fact that they didn't mind taking over Glamis, a company they previously shunned.

Thanks Joe.

I think Glamis was more richly valued then Goldcorp.

I just read an article titled "dreadful stocks to avoid," and it warns about stocks that constantly issue equity.

Wow, good post. Great explanations along the way. I can tell you're a teacher!

Thanks Billybolt. I am pleased you were able to follow the explanations.

Deborah, I enjoyed this post, very good.

Maybe you could do a post outlining the websites you use to find all the information you dig up. I have been finding several useful like sec.gov and sedi but I'm curious what your bookmarks are comprised of when you write a rich post such as this.

Thanks.

herb

Thanks Herby. A lot I find just in reading their financial reports, but also from reading other company's financial reports.

I think having a chemistry degree helps a lot.

I have fairly strong critical reading skills from doing anti-tobacco work. I've read tons of legislation and compared and contrasted it to what it actual says and what people think it says. I think it taught me to catch much more than most people catch.

Interestingly, and probably not coincidentally, Goldcorp CEO Robert McEwen resigned in 2004. This appears to be right before Goldcorp started mercilessly diluting their shares.

From this article:

http://findarticles.com/p/articles/mi_m3MKT/is_36-1_112/ai_n6188324

"McEwen said the company had evolved beyond his skill set"

I wonder if it was dilution expertise that was lacking from his skill set.

McEwen is now at US Gold (UXG). I'm just starting to look into this company although I'm not so much a fan of gold.

(I would tell you this is another great posting Deborah but I imagine you're getting tired of hearing that so I won't. Valuable not only for the information itself but as a template for how one can, and should, research a company. Brilliant.)

Interesting, I had not made the connection as to when the gross dilution and destruction of the company had begun.

I think that without the dilution other business factors would have made the business more challenging anyway.

my comment:

well, Telfer sure has diluted the shares. but so what. he bought assets that will make the company tons of money given the continued metals bull market. some of the assets he bought were among the best the industry had to offer. you can't take a company from being a one horse (one mine) pony to being one of the biggest and most profitable multi-mine producers in the world without increasing the company's share capital. if GG had chosen NOT to grow, the stock wouldn't perform as well as it does. institutional investors wouldn't be as interested in the stock as they now are - they like liquid, well-capitalized shares.

in other words, all this belly-aching is a waste of time. ask the shareholders of GG if they are unhappy - they'll laugh you out of the room.

Something like 10 years ago last month Goldcorp had a drill result with about 9 ounces, or 280g/ton of gold. That gold is mined and sold and gone and is why Goldcorp had such low costs. The reserves/resources have been replaced with some grades that are under 1g/ton.

Last quarter they had no earnings. Check the reports the quarter the year before they reported and promoted the 50c per share instead of the "adjusted" 36c/share. This year they report the 14c "adjusted" instead of the 0c/share.

And what was the number one adjustment? $100 million lost on a currency derivative. Their mines aren't in the US and so their costs are accelerating out of control not only because of the grossly declining grade, but also because of increased costs from currency declines. They report in US and pay many of their bills in other currencies.

What have they got working against them?

1 Grossly declining grade

2 Gross level of shared dilution

3 Grossly increasing costs due to currency declines

4 Continued high dilution for stock options

5 Gross inability to meet mining projections... this year's production has now been reduced 18-22%

6 Hedged copper so they don't get the price correction due to currency decline--they get a double squeeze both increased costs because of currency changes and revenue loss because of hedging.

Creating $6 billion of book value from buying out another company isn't much different then grossly over bidding the value of housing.

http://makingsenseofmyworld.blogspot.com/2007/01/how-i-discovered-gold-bubble.html

Post a Comment