Looking at Poor Operating Margins

I am constantly amazed at the amount of "value" investors are willing to give companies that constantly lose money, or make very little.

Take Sirit, for example, fully diluted at today's 48c/share price they have a market cap of $73 million. To have a P/E of 20 they need to have earnings of about $1 million per quarter. A P/E of 20 is high for any stock, imho, unless you can show good growth prospects.

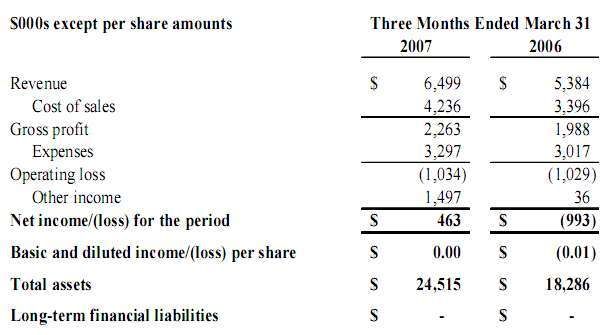

View their first quarter results:

The first thing this one says is that the cost of their supplies is about 65%, leaving them with 35% of their gross revenue to pay all the expenses of running a business. The way I look at it, take that $2.263 million and multiply it forward for four quarters to assess how much money relative to market cap they have to run the business and provide a return to shareholder. It comes to $9.05 million, about 12% of the market cap.

The expenses, $3.297 multiplied by 4 quarters, comes to $13.19 million, or about $4 million more than the than the cash flow. This business is earning -5.7%. They have a one time sale of an asset to make them look cash flow positive this quarter, but one time sale of assets does not continue in earnings. They are essentially seriously cash flow negative.

No comments :

Post a Comment