Deflation Convyer Belt

Counterpunch has an article with a quote I like about the monetary system that is an excellent image of deflation at work:

"Imagine a 200 ft. conveyor belt with two burly workers and a mountain-sized pile of money on one end, and a towering bonfire on the other. Every time a home goes into foreclosure; the two workers stack the money that was lost on the transaction, plus all of the cash that was leveraged on the home via "securitization" and derivatives, onto the conveyor-belt where it is fed into the fire. That is precisely what is happening right now and the amount of capital that is being consumed by the flames far exceeds the Fed's paltry increases to the money supply or Bush's projected $168 billion "surplus package". Capital is being sucked out of the system faster than it can be replaced which is apparent by the sudden cramping in the financial system and a more generalized slowdown in consumer spending."

And a quote within the article:

"A year ago $20 million would have gotten Luminent Mortgage Capital Inc. access to $640 million in loans to buy top-rated mortgage-backed securities. Now that much cash gets the firm no more than $80 million. ... (Only) 6 lenders are offering 5 times leverage, while a year ago, 20 banks extended 33 times."

There have been a few debates about inflation/deflation and the definitions are all over the map and inconsistent with each other. There has already been way more "inflation" than we realize, yet the "price increases" due to the inflation have not worked through the system.

To me, inflation and price increases have been used interchangeably for so long, the concise difference is lost, much like many people interchangeably use minus for negative and vise-versa. In most cases it doesn't matter, people know what you are talking about.

You simply can not have a definition of inflation that includes money supply and price increases and have those definitions really describe what is happening in the economy. They mostly work together, but, the price increases are a delayed response to increased money supply and can be caused by other things. To better understand the common misuse of these words, give this a read.

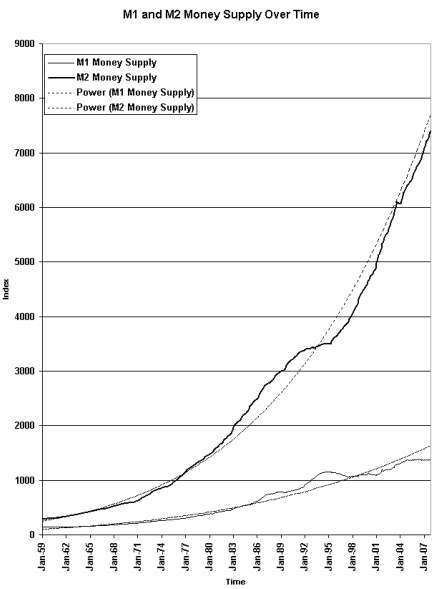

The money supply has already increased to the point that we should all feel utterly sick about it, as the graph shows:

The developments over the past 10 years in the financial industry have effectively increased the rate of growth of the money supply. I am not sure where the mortgage bonds, etc., show up in the tally of the money supply, and they thwart the intention of regulations that required a level of reserves for credit. So regulations that were intended to control the increase of money supply through credit completely fail and we have the banks acting like Sammy Slimy with his printing press in his basement.

This gross level of increased money supply has only been showing up in a few areas, the cities with homes priced 5-12 times median wages, commodities like copper which was under $1 in 2002 but peaked at over $4 and has ranged between $3-4 since the peak. The same is true for all base metals, and it seems to me with their vast expenditures and need for raising capital to build new mines, well, they are first in the price food chain and responded to the increased money supply early. Sure there is also supply and demand, but the price increases of the 21st century are far beyond any reasonable historical increases and I would suggest the back room banking activities comparable to Sammy Slimy with his illicit printing press in his basement are responsible and the only real commodity that we use everyday and see in our home balance sheets that has adjusted to the increased money supply is oil.

There is no question there are going to be some fairly significant price increases coming, but these are in response to previous inflation, and aren't here yet due to the time delay in working increased money supply into the system.

The US has an increased delay for inflation to translate into price increases because of its status as a world reserve currency. The volume of US dollars sitting in foreign bank accounts effectively takes those dollars out of circulation and prices are as though they don't exist. Some say the US has effectively been exporting their "inflation" because of this practice... Just look at China's double digit inflation...

The trend of foreigners taking US dollars out of circulation is reversing and that's going to show up as price increases, but it is not an increase in the money supply. That has already happened to an extent far beyond the current pricing of goods. There are so many of those dollars out of circulation, well, it has resulted in a totally unrecognized degree of privilege in buying power, and a privilege that has been taken for granted and completely unrecognized as to where it comes from.

Those dollars head home, or the rate they are bought up by foreigners simply slows down or stops, and the privilege ends and the value of American output gets repriced towards the value the rest of the world gets for their output. The stagnant wages despite increases in the money supply suggest that that process has begun, although sectors with first access to the gross increases in money supply have seen wage increases far beyond other sectors of the economy over the last ten years, the financial sector and sectors related to home building would be examples.

And the people who work in the sectors that saw the largest benefit will be the hardest hit with the current deflation of the money supply. Their wages will decline the most and they will have the hardest time adjusting to the lesser lifestyle.

So, there will continue to be price increases due to the current money supply, but the money supply is deflating and there is a highly leveraged effect of this deflation. Right now I'd say the mortgage backed bond holders are taking the largest hit of the current deflation, followed by home owners in bubbled cities, and somewhere in there is the highly leveraged investor, either through direct personal choice, or indirect personal choice of a highly leveraged invest fund of some kind. These price decreases are a result of deflation, or a reduction of money supply due to credit contraction.

Update: Here's a good post, one I recommend having a read.

2 comments :

I have been hearing a lot about the inflation/deflation debate lately. 1 thing I'm not sure the deflationists take into account properly is the trade deficit. If foreigners are absorbing american dollars, how is that decreasing the money supply? The money is still there, it's just not owned by american's.

Also, as you eluded to, it seems likely that the dollar will continue to decline against other currencies. If the dollar declines in value, ultimately will this not continue to increase costs?

The credit expansion of the money supply is leveraged, enormously so.

Something that I am still thinking through in my head is those dollars coming back work into the whole thing. I don't think the US banks have them leveraged, or at least that's my first thoughts about them, mean they come back and work into the economy they might correct the gross leverage imbalance, or at least that's what I'm thinking through right now.

The way that money supply graph looks right now it is like consumer goods have to triple or quadruple to catch up with it... That's existing money supply... I think you get a decrease in the money supply, but you do get price increases because right now they are so out of line with the money supply.

If prices go up more than 3-400% over the next 10 or so years, then I was wrong about deflation, or contraction of the money supply.

Look at the M1 and M2 money supply and you see the M1 is up maybe 20% over the past 10 years. The M2 money supply doubled. I suspect the money supply has been increased by far more because of the unregulated changing the mortgages into bonds and taking them off the balance sheets. I don't know where that gets accounted for in this mess.

But, with credit, $1 billion gets leveraged to $12.5 billion in the economy, normally. The estimates I've read are that now it has been getting leveraged to $30 billion. Well, if a billion comes back to be spent, but the banks are working towards that traditional $12.5 billion leverage, $17.5 billion in leveraged dollars disappearing and the billion coming back is tiny by comparison.

I think the declines from credit contraction exceed any money coming back to be spent.

Big ticket items that got hit first from the credit expansion of money supply come down. Consumer prices go up, but that is still responding to existing money supply, but, if the money supply doesn't contract, they go up 3-400% to catch up to the money supply.

Post a Comment